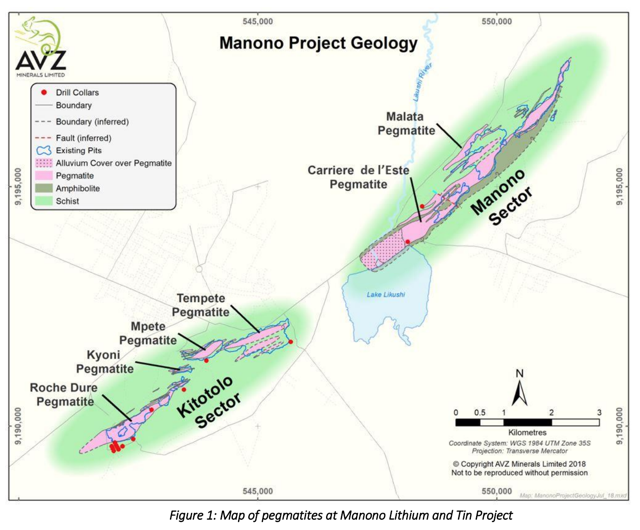

AVZ has a 75 percent interest in the Manono Project. Rimon Law acted as the company’s OTCQX sponsor.ĪVZ Minerals Limited is a mineral exploration company focused on developing the Manono Lithium and Tin Project located in the south of the Democratic Republic of Congo (DRC) in central Africa. “We believe AVZ’s admission to the OTCQX Best Market will benefit all of our shareholders, enhancing the visibility and accessibility of the Company to US investors, allowing the Company to efficiently grow its North American shareholder base”. To qualify for OTCQX, companies must meet high financial standards, follow best practice corporate governance and demonstrate compliance with applicable securities laws.ĪVZ Minerals Limited Managing Director, Mr Nigel Ferguson, said: “AVZ Minerals has long recognised the opportunities provided by the North American capital markets and with a burgeoning interest in the global lithium sector, the Company’s majority owned Manono Lithium and Tin Project is generating significant investor interest”. For companies listed on a qualified international exchange, streamlined market standards enable them to utilize their home market reporting to make their information available in the U.S. investors can find current financial disclosure and Real-Time Level 2 quotes for the company on Upgrading to the OTCQX Market is an important step for companies seeking to provide transparent trading for their U.S.

AVZ Minerals Limited upgraded to OTCQX from the Pink® market.ĪVZ Minerals Limited begins trading today on OTCQX under the symbol “AZZVF.” U.S. and global securities, today announced AVZ Minerals Limted (ASX: AVZ OTCQX: AZZVF), a mineral exploration company, has qualified to trade on the OTCQX® Best Market. (OTCQX: OTCM), operator of financial markets for over 11,000 U.S.

13, 2022 (GLOBE NEWSWIRE) - OTC Markets Group Inc. We look forward to continuing to support AVZ on its journey to closing the deal and developing the project.NEW YORK, Jan. The project is strategically positioned as a clean, sustainable source of lithium for the EV battery value chain. The DLA Piper team was led by Corporate partner James Nicholls, Global Co-Chair of Energy & Natural Resources Alex Jones, Finance & Projects partner Tom Fotheringham and special counsel Joanne Steer, supported by partners Natalie Caton, Shane Murphy and Alexander Brabant counsel Bruno Gay senior associates Claire Robertson and Jeffrey Sheehy and solicitor Kirsty Hall.Īlex Jones said: “DLA Piper is proud to have supported AVZ on this deal, which will see the Manono Project become one of the largest lithium mines in the world. The parties have also agreed to evaluate and, if viable, develop and construct a lithium hydroxide conversion facility. Additionally, CATH will enter into a long-term Primary Lithium Sulphate (PLS) offtake agreement in respect of PLS produced from a PLS calcining plant, to also be developed in joint venture with CATH. The transaction will yield a significant portion of the required project funding whilst ensuring AVZ retains a controlling 51% interest in the Manono Project post completion and holding its position as lead developer of the Manono Project.ĬATH will replace Yibin Tianyi under the existing Offtake Agreement between those parties, which will now provide for the sale of an increased quantity of spodumene concentrate for the life of the Manono Project. Global law firm DLA Piper has advised AVZ Minerals Limited (AVZ) on securing a cornerstone investor, Suzhou CATH Energy Technologies (CATH), for the development of the Manono Lithium and Tin Project by entering into a transaction implementation agreement to earn a 24% joint venture interest in the Manono Project for USD240 million.Īs the joint investment vehicle of Mr Pei Zhenhua, the controller of Yibin Tianyi, and Contemporary Amperex Technology Co, Ltd, CATH is a major player in the global lithium conversion and lithium-ion battery industry.

0 kommentar(er)

0 kommentar(er)